Anti-Nuclear NRDC Defends PG&E's Diablo Canyon Nuclear Cost Estimates, But Offers No New Evidence

Anti-nuclear NRDC attorney, Ralph Cavanagh, defends PG&E's false Diablo Canyon nuclear power plant cost estimates.

The anti-nuclear lobbying firm, NRDC (Natural Resources Defense Council), which is heavily invested in natural gas and renewables stocks, is defending as legitimate the false cost data provided by Pacific Gas & Electric to the California Public Utilities Commission.

As background, Environmental Progress (EP) yesterday published evidence showing that PG&E invented future cost data for Diablo Canyon nuclear power plant that it knows to be wrong.

EP discovered that the State and PG&E both had ruled out cooling towers 15 years ago, and instead opted for building an artificial reef and land conservation costing somewhere around $50 million — about $9.95 billion less than the $10 billion cooling towers. (See longer explanation below.)

In an interview with Utility Dive, NRDC's Ralph Cavanagh said the fact that it's PG&E that is giving the far higher cost estimate somehow makes it believable. "The fact that the owner is the source of the numbers makes that a more difficult case to make."

Cavanagh's proposal that the California people just trust PG&E's numbers — after everything that's happened with PG&E and the CPUC over the last five years — is offensive.

But Cavanagh goes further — and errs badly. He tells Utility Dive:

But if you look at the PG&E cost estimates, it isn't even clear that cooling was dispositive. PG&E concluded it was more than $0.10/kWh and even if you took the cooling costs out you'd still be at $0.08/kWh.

The $0.08/kWh number is inaccurate, and it is not clear where Cavanagh got it, or how he arrived at it. It is not in PG&E's application. And it is 40 percent higher than the $0.057 estimate that was given by PG&E (in 2013) and the other other anti-nuclear groups NRDC is working with to shut Diablo Canyon (they all arrive at similar numbers per KWh but offer slightly different numbers in total).

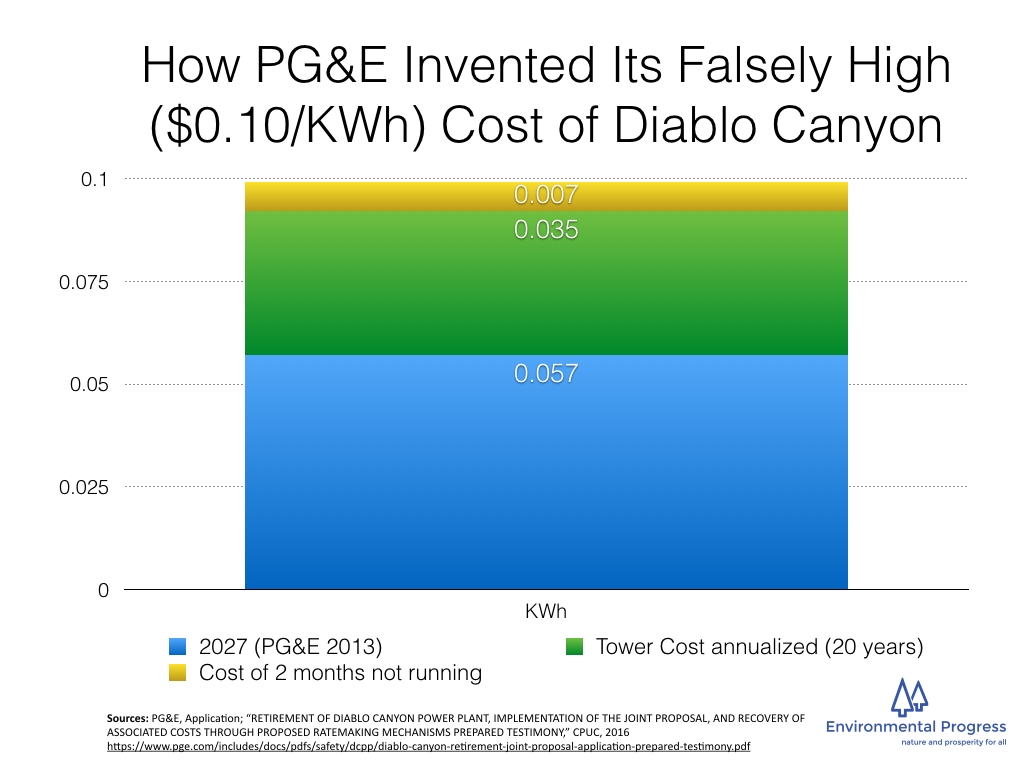

The $0.10/kWh number cited by Cavanagh is accurate, and appears to have been constructed by PG&E by adding $0.007 kWh for shutting down the plant two months per year (supposedly to comply with once-through-cooling regulations, even though this has never been proposed anywhere) and a very high $0.035/kWh estimate for water towers, to its earlier (2013) estimate for 2027.

In other words, the cost of Diablo Canyon in 2030 without water towers would be $0.064/kwh not $0.08.

The highest estimate given for Diablo Canyon water towers is $10.1 billion, which would add $0.40/kWh. That is, PG&E didn't choose the very highest water tower cost, but one very close to the highest.

PG&E appears to have constructed its falsely high estimate of the cost of Diablo Canyon in 2030 by including the cost of not running the plant for two months to comply with once-through-cooling requirements — which is something PG&E appears to have made up whole cloth — and adding cooling towers, which California State officials and & PG&E's own consultant rejected 15 years ago.

Further, Cavanagh suggests that $0.02/kWh is minor -- in fact, it's nearly half of Diablo's current cost (which includes 11.8% profit).

In short, the evidence that PG&E has deliberately manipulated future cost data is crystal clear. The cost data is central to PG&E's case to CPUC to raise rates. And CPUC cannot legally allow PG&E to raise rates based on this false cost data.

More Reading:

Background (Excerpt from Environmental Progress "Protest")

PG&E's account of OTC is misleading in several ways:

PG&E’s Proposal and Testimony ignore the fact that framework for an OTC mitigation settlement was already negotiated and focused on land conservation and artificial reef.

In 2000, the Central Coast Regional Water Quality Board created the framework for an OTC settlement with PG&E. Michael Thomas from Board oversaw the process, and hired Peter Raimundi from UC-Santa Cruz who worked with PG&E consultant John Steinbeck of Tenera Consultants. In January 2016, all three men were interviewed by Michael Shellenberger and the transcripts of the interviews are attached as an appendix.

The Regional Water Board — not the State Water Board, as PG&E claims — decides on OTC compliance. Explained Michael Thomas of the Central Coast Regional Water Quality Board: “Both boards have a role, but the Regional Water is who decides whether to adopt cooling towers.” Indeed, as we’ll note below, the State has deferred to Raimondi, Thomas and Steinbeck.

The artificial reef was proposed at one-time cost of $15 - $50 million. According to Raimondi’s presentation to the State Water Board, and based on research with Steinbeck and Thomas:

“An artificial reef of sufficient size and with appropriate design and placement could compensate for the majority of impacts associated with entrainment at DCPP….The estimated cost for the construction of an artificial reef ranged from 15 million to 50 million dollars.”[17]

Rainmodi (2016):

“We proposed compensatory mitigation through habitat creation. Most species affected were ones associated with rocky subtidal reefs. So we proposed they build artificial reefs. There was precedent in southern California where for SONGS a compensatory reef was built and is still operating…. The cost of the construction of the San Onofre artificial reef was $30 to $35 million, and that’s close to the estimate from Diablo.”

The negotiated settlement focused on land conservation. Said Thomas, “We came up with a package that comprised several million in projects and the setting aside about 2,000 acres of land north of the power plant in a conservation easement.”

The cost of land conservation was estimated at $4.3 million per year. According to Thomas:

For Diablo, if you go through the calculations, OTC compliance comes out to $4.3 million per year, for 2.5B gallons a day. PG&E can pay the $4 million per year. The State Water Board preference is that that the money goes toward supporting and implementing the marine protected areas. So if you establish marine protected areas, it would help make up for losses by the power plant

When we did it with PG&E it was several million plus the land. They could pay $4.3 million a year, or they could propose something else. What they propose is pretty wide open. They could say they’ve already taken mitigation measures that should be taken into account. There’s only one case where a power company has done that, and it was approved. I would expect PG&E to document everything they have done that they could consider beneficial to environment and make that as compelling as possible.

All the parties rejected cooling towers, including the Water Board. Said Thomas, “I don’t think they are feasible or optimal. There have been multiple studies for towers that aren’t feasible. We hired our own consultants separate from PG&E and they came to same conclusion.”

Said PG&E’s consultant Steinbeck, “PG&E may make the decision to shut Diablo Canyon down but under existing state regulation they can continue to operate without building cooling towers. PG&E just needs the Board to make decision that we’re going to do this or that and then come up with a proposal and then they’re going to move forward with that. I don’t understand why PG&E is so concerned.”