Why its Big Bet on Westinghouse Nuclear is Bankrupting Toshiba

For additional reading please see:

Toshiba, the venerable 80 year old Japanese electronics giant, appears to be going bankrupt.

Toshiba was supposed to have announced at least $6.3 billion in losses during an earnings call yesterday. Instead, it cancelled the report, saying "it was not able to immediately secure the approval of its auditor."

Financial Times reports that "The delay to publication of Toshiba’s earnings came as the company said lawyers were examining claims by a whistleblower in the US that Westinghouse mishandled its takeover of Stone & Webster."

Toshiba's losses stem from its construction of new nuclear plants in the United States.

The collapse of Toshiba will result in the halting of all new nuclear power plant construction by its US-based subsidiary, Westinghouse.

Toshiba's failure also raises the question of what happens to the Vogtle plants if Toshiba fails? Does it open two southeastern U.S. utilities — Southern and SCANA — up to exposure to Toshiba shareholder lawsuits? And who will build future U.S. nuclear plants?

How Bad Is It?

The loss estimate is already $2.6 billion higher than the estimate Toshiba gave in December, and could go higher.

The reason it could go higher is that nobody knows how long it will take to finish the U.S. plants, which are three years behind schedule and billions over budget.

Toshiba as recently as last June had as its goal the construction of 45 nuclear reactors around the world, including two in the UK, six in India, and possibly two more in Georgia, all using Westinghouse’s design, the AP-1000. Future Westinghouse reactors will either be built by some other company or not at all.

Toshiba's last auditor, Ernst and Young, was fined $17.5 million in 2015 after failing to blow the whistle on an accounting scandal. In January, Japanese prosecutors charged that Toshiba executives exaggerated profits by $339 million over three years.

The announcement comes less than two years after the $5.3 billion bail-out by the French government of Areva, its state-owned nuclear company, currently undergoing a massive reorganization.

Nuclear energy is, simply, in a rapidly accelerating crisis:

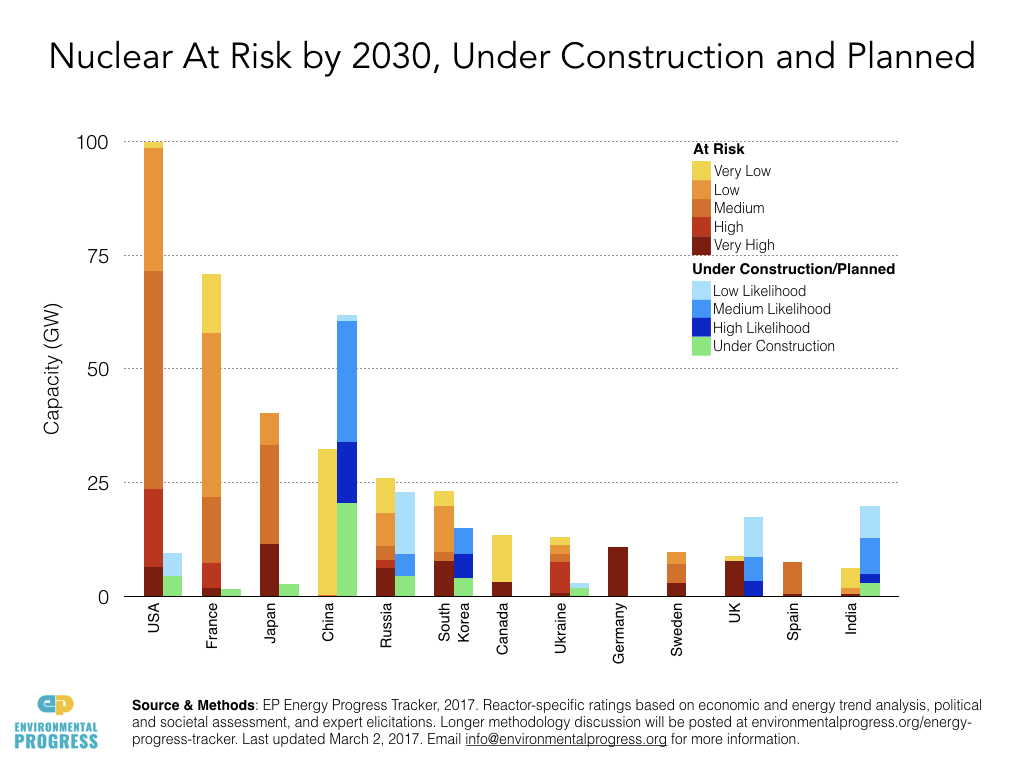

· Demand for nuclear energy globally is low, and the new reactors being built may not keep up with the closure of nuclear plants around the world. Half of all U.S. nuclear plants are at risk of closure over the next 13 years.

· Japan has only opened two of its 42 shuttered nuclear reactors, six years after Fukushima. Most experts estimated it would have two-thirds open by now. The reason is simple: low public acceptance.

· While some still see India as a sure-thing for nuclear, the nation has not resolved key obstacles to building new plants, and is likely to add just 16 GW of nuclear by 2030, not the 63 GW that was anticipated.

· Vietnam had worked patiently for 20 years to build public support for a major nuclear build-out before abruptly scrapping those plans in response to rising public fears and costs last year. Vietnam now intends to build coal plants.

· Last month Entergy, a major nuclear operator, announced it was getting out of the nuclear generation business in states where electricity has been de-regulated, including New York where it operates the highly lucrative Indian Point.

With the French nuclear industry crippled and Toshiba-Westinghouse out of the nuclear construction business, the West is effectively ceding the future of nuclear energy to China, Korea and Russia.

What Happened to Standardization?

The AP-1000 is a “Generation III+” design like the European Pressurized Reactor (EPR). The EPR, like the AP-1000, has experienced construction delays — only far more extreme. Construction began on its FOAK Finland in 2005 and was supposed to have finished in 2009. It now says it will open in 2019.

The conventional wisdom among nuclear experts had been that the AP-1000 was superior to the over-built EPR with its ostentatious double containment dome. The AP-1000 would be built faster and more cheaply than the EPR, many thought.

While the EPR’s delays will likely be longer, and while Toshiba and Areva will restructure their nuclear businesses differently, it is notable that both companies bet -- and lost --- big on radically new designs.

Why did Westinghouse push forward with a new and untested design -- the AP-1000 -- in the first place, instead of building more of the same reactors it had in the past?

Already by the early 1970s, U.S. nuclear plant operators were seeking to standardize nuclear plant design to reduce the time and cost of licensing and construction.

In the 1980s, a utility coalition came up with a Utility Requirements Document to identify the things utilities wanted in a reactor to come up with a standard design, rather than plants unique to each site. AP-1000 was the outcome of that process of seeking standardization.

With the AP-1000, the idea was that the Nuclear Regulatory Commission (NRC) would license the plant and reactor design just once, giving its owners the security of moving forward with construction plans without fear that their design would be rejected by NRC.

Standardization was expected to also be important in mass-manufacturing modules that could then be assembled on site.

It didn't turn out that way. There were significant delays in both construction of the basic foundation, and in manufacturing the modules.

In the U.S. and China, AP-1000 plants are three years behind schedule.

Toshiba’s losses stem from Westinghouse’s purchase of CB&I’s Stone and Webster, one of the main construction companies building the AP-1000 in Georgia and South Carolina.

Stone and Webster had been bought earlier by Shaw Group.

None of them had had any experience building nuclear plants.

Westinghouse made the purchase to settle the lawsuit against it by CB&I and by Southern and Scana, and because it thought it could do a better job than Stone and Webster.

All parties had sued Westinghouse saying they had been misled into believing the design was done. “Westinghouse’s response was effectively don’t blame us and you should have known better,” a person close to the situation told me.

China made similar complaints years earlier. “People felt we paid full price for a half-completed design,” a Chinese nuclear engineer told me in 2015. The result was three years of delay, higher costs, and deteriorating relationship between China and Westinghouse.

How Construction Failed

Construction began in China and in the US before all of the performance testing had been completed. There was less “learning-by-doing,” the American source told me, than there should have been since the Chinese and American projects were overlapping instead of sequential.

As part of its settlement, Toshiba reaffirmed its fixed price guarantee, even though it did not have a good handle on how much was left to do.

The American side was inexperienced. "Although an experienced nuclear engineer, [Westinghouse's] Mr. Benjamin had never actually overseen construction of a new nuclear-power plant," noted Brian Spegele of Wall Street Journal in December.

The things that caused delays were often mundane: simply laying concrete and re-bar in accordance with the drawings. “The plant’s containment and cooling towers are done,” a different source told me. “It’s all the re-bar and concrete work that’s taking time.”

Vogtle’s builders struggled to create the special materials required for the plant as well as with documentation to meet NRC’s stringent standards.

That didn’t always work. I was told that a dispute between an on-site NRC inspector and project manager over whether a 1973 or 1990 standard should be used delayed construction for six months. The area in question was just 20 cubic yards in a 2,000 cubic yard foundation.

The Georgia PSC and Georgia Power have tried to streamline regulations to reduce conflicts over change orders, but it’s not clear how much of it has worked.

One of the problems was that NRC imposed new regulations on the AP-1000 after it had already approved the Westinghouse design in 2006. The first was the Aircraft rule and the second were rules created after Fukushima.

“The design revisions required to meet the Aircraft Rule changes involved at least three more design revisions that did not get final approval until Jan 2012,” noted Rod Adams. “Completely different construction techniques needed to be invented, tested, litigated and approved.”

However, I was also told that Westinghouse sought an alternative construction technique for the shield building, and that the company could have stayed with its standard construction and not experienced delays.

How Lack of Demand and Over-Regulation Slowed Construction

Deliberate foot-dragging to raise costs by US plant builders and module manufacturers appears to have been a significant factor in addition to poor management and inexperience.

Once it became clear to suppliers and contractors there would not be any more AP-1000 nuclear power plant builds in the US thanks to low natural gas prices and the absence of subsidies that make building wind and solar attractive, suppliers had no incentive to perform their work quickly.

“If he could get cement change orders,” one person told me, “all the better for adding cost. And there’s no downside to being embarrassed because of slow or poor work since there’s no future market.”

NRC in 2013 took action against CB&I to fix its workplace culture, and NRC inspectors are at CB&I’s Louisiana site.

Disincentives for operating efficiently combined with lack of experience and over-regulation to result in delays. When managers would complain about the slow pace and seek to speed things up, some workers would say that any effort to make the process faster would compromise on safety. That would often be enough to make managers under the watchful eyes of NRC inspectors err on the side of slowness.

“The cost overrun situation is driven by a near-perfect storm of societal risk-aversion to nuclear causing ultra-restrictive regulatory requirements, construction complexity, and lack of nuclear construction experience by the industry,” Lake Barrett, a former official at the U.S. Nuclear Regulatory Commission, told Japan Times.

The NRC had turned down requests by anti-nuclear groups to impose Aircraft rule in 1982, 1985 and again in 1994. After 9/11, the NRC caved in to demands, even as it declared point blank that the Aircraft Rule would not improve safety, and that it would only apply the rule to new plants — including non-light water reactors.

Nuclear power’s worst accidents cause less harm than the normal operation of fossil power plants and yet the latter, unburdened by debates over how to pour 20 cubic feet of cement, can be constructed far more quickly.

There is unlikely to be higher demand and lower costs for nuclear without higher social acceptance, and there is unlikely to be higher social acceptance without overcoming the fears.

Nations are unlikely to buy nuclear from nations like the US, France and Japan that are closing (or not opening) their nuclear power plants.

“They hear the Japanese telling potential customers, ‘Nuclear is safe enough for you, but not for me,’” a source close to Toshiba told me. "That's not going to work."

Why Korea Won

Korea is winning the global competition to build new nuclear plants against China and Russia despite being a fraction of the size, at just 50 million people, and energy-poor.

It has done so through focus: standard design, standard construction of plants, standard operation and standard regulation. Korea's nuclear plants are plug-and-play.

Studies show that standardized designs, multiple reactors on one site, and a vertically integrated builder were the keys to declines in the cost of building nuclear power plants in France and Korea.

It’s easy to understand why. New designs interrupt the process of learning-by-doing and continuous improvement that allow things to move more quickly.

Standardization is especially important to nuclear because so many people and institutions — the designer, the builder and many subcontractors, and the regulator — are needed to work in synchrony to do anything. Any single actor can slow the process down.

Realizing the benefits of standardization requires repetition. Because it takes so long to build a nuclear plant — between two and ten years on average — a senior construction manager will only have a limited amount of experience building before retiring.

Korean nuclear construction managers are promoted as they go from project to project, their careers as well-planned as the projects themselves.

What’s true for construction is also true for operation. After Three Mile Island meltdown in 1979, nuclear operators organized to improve safety and performance.

Increasing nuclear power plant efficiency from 1980 to today came from two areas: first, improvements to how operators re-fuel reactors, and keep plants and their workers safe; second, increasing the heat and electrical generation of plants through “up-rates.”

Both required greatly improved training systems and industry cooperation. So-called “soft” factors like safety culture, regular training, and the constant re-writing of procedure manuals proved crucial.

Since then, U.S. nuclear plants have gone from producing power about half the time to producing power 92 percent of the time.

AP-1000 was a radical innovation. Based on a plant that had never existed — the AP-600 — the plant was, like Areva's European Pressurized Reactor (EPR), a radical break from the past.

Everybody who has an innovative design to sell promises that their design will triumph over all others, and become the industry standard. A few years later, someone else has a better design to sell.

Radical breaks from past designs sometimes work in industries that require little up-front capital, like Internet companies.

It's now clear that they are deadly when it comes to nuclear.