Renewables Subsidies Are Killing Nuclear and Threatening Climate Progress

Intermittent solar and wind must be backed up by fossil fuels like methane, seen here leaking here from Aliso Canyon in California. Source: Environmental Defense Fund

by Will Boisvert

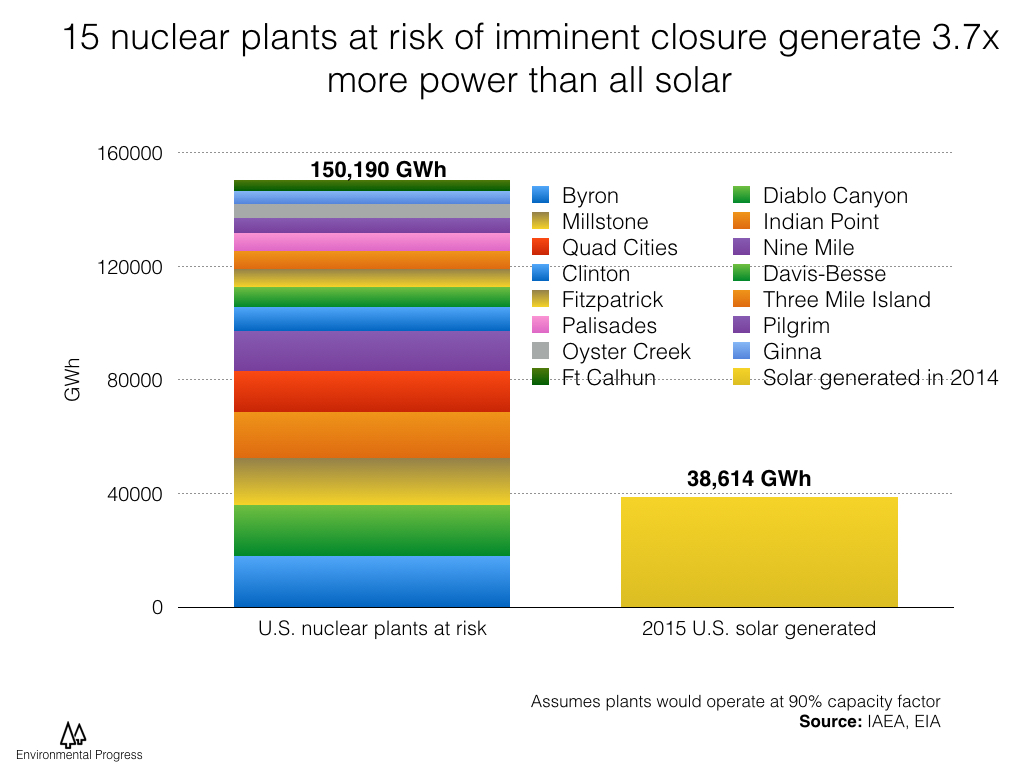

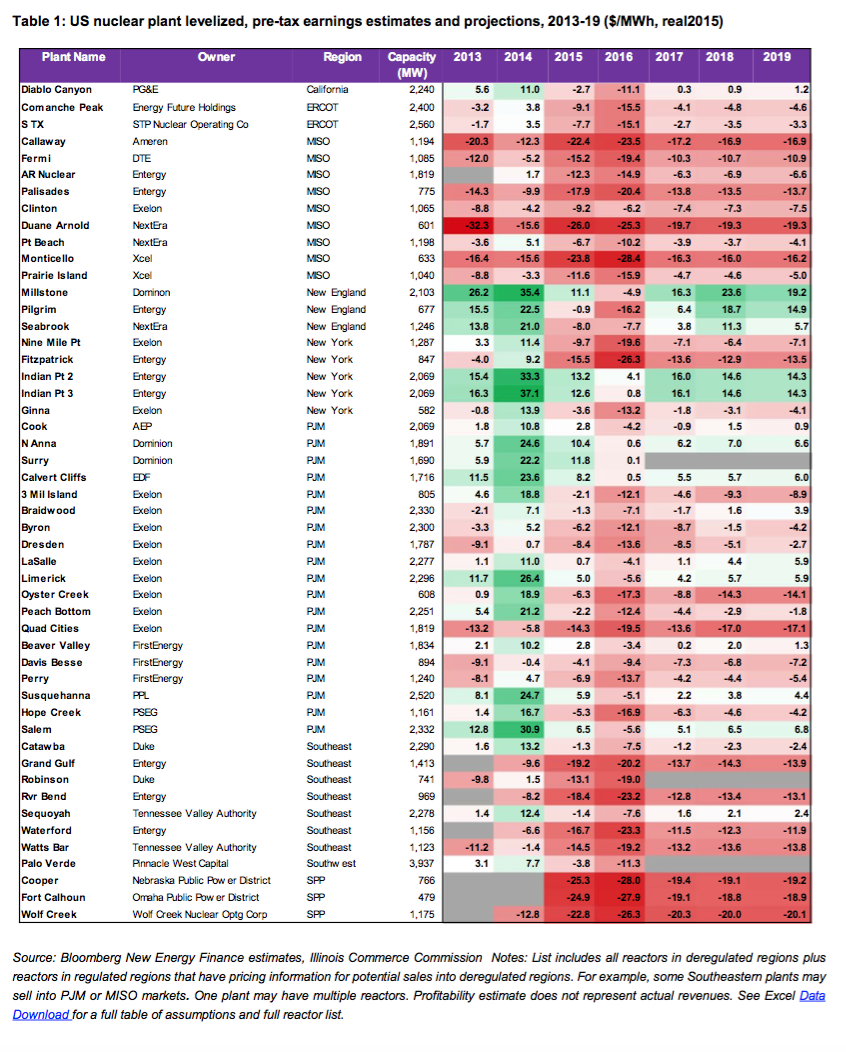

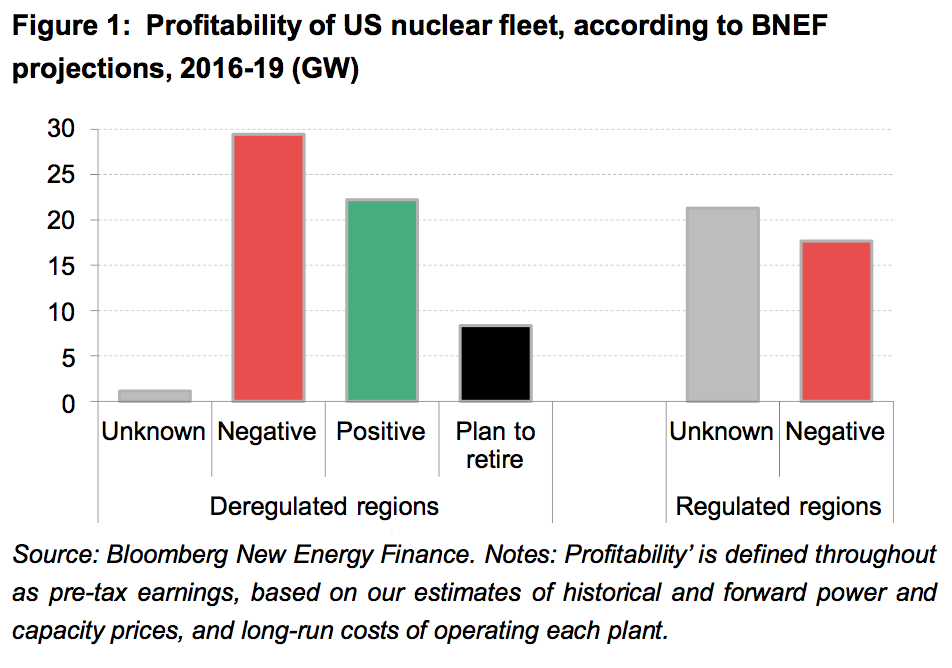

Bloomberg New Energy Finance recently published a major new report, "Reactors in the Red: Financial Health of the US Nuclear Fleet," showing that 55 percent of America’s nuclear plants are losing money and are at serious risk of being replaced by fossil fuels.

Some will seize on this news as proof that nuclear is inherently uneconomical, but that's just wrong: nuclear plants’ financial woes, the Bloomberg data show, could be remedied by subsidies substantially smaller than those given to renewables.

The Bloomberg report highlights deep dysfunctions in America’s changing electricity system. The immediate problem is a depressed electricity market that chokes off nuclear plants’ revenue. But beneath that are counterproductive energy policies that will result in a wasteful glut of capacity, perpetually falling prices and rising costs.

Source: Bloomberg New Energy Finance, "Reactors in the Red: Financial Health of the US Nuclear Fleet," July 7, 2016

We need only look at California, where renewable power is at risk of ousting the state’s last nuclear plant from the grid—and raise carbon emissions in the process—to see where ill-judged energy policies are leading the country.

Renewables and the Crisis of Overproduction

Why are nuclear plants going broke? The immediate reason is cheap gas. The plunge in natural gas prices caused a collapse in the price of natural gas-fueled electricity, which has slumped below the production costs of nuclear plants. Bloomberg predicts that in the sprawling PJM grid wholesale prices will be $28.50 per megawatt-hour in 2017, lower than average nuclear production costs of $35.50 per megawatt-hour. Facing losses like that, nuclear utilities are closing up shop.

But the impact of market forces has been worsened by public policy that neglects nuclear power and adds to the pressure it faces. Federal, state and local governments have massively intervened in energy markets to support renewable power with subsidies and mandates, but given virtually no support to existing nuclear plants. These biases tilt the playing field for commercial competitors of nuclear plants.

The $23 per megawatt-hour federal Production Tax Credit for wind farms, for example, can be larger than the total wholesale price nuclear plants get for their power in some regions, according to Bloomberg data. (It’s also larger than the $5-15 per megawatt-hour subsidies Bloomberg reckons nuclear plants need to break even.)

Source: Bloomberg New Energy Finance, "Reactors in the Red: Financial Health of the US Nuclear Fleet," July 7, 2016

State renewable portfolio standards require utilities to bring new renewable capacity onto their grids no matter how much it depresses markets, and renewable subsidies further erode electricity prices, especially in Midwestern states where subsidized wind farms bid very low—even negative—prices for their power.

While renewables advocates often think of negative pricing as manna from heaven, it actually means that system operators are desperately trying to shed excess generation when unneeded surges of wind or solar power are threatening to crash the grid. During these crises of overproduction, nuclear plants have to pay to send power to the grid.

These market distortions might subside if we could retire fossil-fueled plants as the wind and solar sectors grow. Unfortunately, we can’t. Intermittent power has to be backed up by an equivalent capacity of dispatchable power, and that means fast-ramping gas plants that can rapidly adjust to chaotic surges and slumps of wind and solar power.

As wind and solar capacity swells without displacing conventional capacity, the grid enters a spiral of persistent and rising overcapacity that lowers prices even further as more gigawatts fight for market share. Worse, as wind and solar capacity climbs the returns of usable power diminish because of increasing curtailment during surges that the grid can’t absorb.

More and more intermittent capacity has to be pushed onto the grid to get less and less additional renewable electricity. The dynamic of soaring overcapacity and falling prices is the inevitable result of the fundamental inability of intermittent wind and solar generators to efficiently match supply to demand.

So far this has had a minor effect on US electricity markets compared to the influence of cheap gas. But it is already being felt in Europe and some Midwestern states with modest intermittent penetrations. It will grow as government policies mandate higher penetrations of wind and solar. Which means that, in the long run, today’s depressed markets and tides of red ink are the new normal—electricity prices will probably never recover.

It’s not outlandish to imagine a future where renewable overcapacity is so severe that electricity is essentially free—or, rather, worthless. In that world, no power plant will be able to make money selling kilowatt-hours. It may be that revenues will come entirely from capacity markets—payments for being ready to produce power on demand—but unreliable wind and solar will lose that competition to reliable conventional generators.

Source: Energy Information Administration

More likely, every power plant will be subsidized by the government and regulated with quotas and preferments. Germany has already started a subsidy for fossil-fueled plants bankrupted by the plunge in electricity prices—a subsidy that will just add to the very high surcharges levied on captive German rate-payers to reimburse renewable sources for costs they can’t recover from market.

In an unfettered market wind and solar would be strangled by their own overcapacity before conventional generators would be. But they will flourish for a while with subsidies and mandates.

Meanwhile conventional plants will battle it out to see which survive as the indispensable backstop of the electricity system, with the advantages of cost and policy preferment currently accruing to gas plants.

The Bloomberg report shows us the results—the replacement of low-carbon nuclear power with a mix of mainly natural gas and some renewables, with much higher net greenhouse emissions.

Source: Bloomberg New Energy Finance, "Reactors in the Red: Financial Health of the US Nuclear Fleet," July 7, 2016

Beware the California Model

Last month’s decision to close California’s Diablo Canyon nuclear plant offers a microcosm of these forces in action as clean renewables crowd clean nuclear off the grid for a net rise in greenhouse emissions.

If enacted, the Joint Proposal struck between Diablo’s owner Pacific Gas and Electric (PG&E), two utility unions and anti-nuclear groups Natural Resources Defense Council, Friends of the Earth, Alliance for Nuclear Responsibility and Environment California would close Diablo by 2025 when its license expires. The Proposal promises to replace Diablo’s 17,660 gigawatt-hours of annual output with renewable energy and efficiency, but its provisions only account for 4,000 gigawatt-hours of lost output.

Motivating the deal was the green groups’ threat of ongoing lawsuits against the plant and encouragement of costly regulatory impositions, and their promise to support full cost-recovery for PG&E if it closed the plant.

But even more important was the tangle of state energy policies that made it virtually impossible to keep the plant in operation.

California’s aggressive renewable portfolio standard, mandating that utilities source 50 percent of their electricity sales from renewables by 2030, meant that PG&E would have to put a lot more renewable power into its existing mix.

At the same time, state energy-efficiency mandates would force it to reduce generation, while new measures liberalizing the electricity market meant PG&E would lose much of its customer base to other providers. With PG&E having to shoehorn more renewable power into a shrinking sales base, existing capacity would have to close to make room.

The obvious choice was Diablo, which would not be as adept at backing up new wind and solar power as nimble gas turbines are. California already has to curtail solar power surges on some days, and PG&Es projections showed that rising solar capacity would make surges bigger and more frequent.

Increasingly, not only PG&E's gas plants but Diablo itself would have to ramp down to accommodate surges that would otherwise crash the grid. That’s a difficult operation for a nuclear plant, as is ramping back up when the sun sets.

Of course, the problem of solar oversupply could be solved by simply curtailing excess solar power during surges—it doesn’t help to replace clean nuclear power with clean solar power—but PG&E has a renewables quota to meet. The company foresaw that it would have to curtail Diablo more and more often and that swelling intermittent overcapacity would more generally depress electricity markets, pushing the marginally profitable plant into the red.

So to comply with the state’s decarbonization rules PG&E agreed to shut down a zero-emissions plant and replace it with a mix of gas and renewables with much higher carbon emissions. That seemingly irrational decision was perfectly rational from the utility’s viewpoint, because California does not recognize nuclear power as low-carbon energy nor discourage a utility for replacing it with fossil fuels.

All of this was spelled out in the Joint Proposal and in press conferences by PG&E and anti-nuclear groups. The only obfuscations were the breezy assurances from all parties that Diablo would be replaced pristinely by renewables and demand reduction. Almost none of the former was specified, and much of the latter is an illusion of the anticipated offloading of PG&Es customers to other companies.

In fact, PG&Es own scenarios show that closing Diablo to make way for solar is a serious blunder from a decarbonization standpoint.

The company’s 2030 forecast shows that with its program of closing Diablo, increasing renewables and reducing demand through efficiency and customer defections it would still generate 24,000 gigawatt-hours of electricity from natural gas.

But if it kept Diablo open and did not build any new renewables, it could reduce natural-gas generation by 25 percent to 18,000 gigawatt-hours—with a reduction of 2.4 million tons of carbon dioxide annually.

A Diablo closure would be a boon for the market share of the renewables sector, but a set-back for decarbonization.

Can Nuclear Survive?

Gas prices look to remain low for a long time, but even if they rise there is no way out of the dynamic of over-capacity and plunging electricity prices as long as subsidizing wind and solar is the government’s main energy initiative.

Column 1: PGE’s forecast generation mix in 2017; Column 2: PGE’s forecast generation mix in 2030 after closure of Diablo Canyon; Column 3: PGE’s generation mix in 2030 if Diablo Canyon stays open and no renewable capacity is added after 2017 (All Units in terawatt-hours).

Source: PG&E and M. J. Bradley and Associates

This isn’t a problem with nuclear power. Creeping over-capacity will sap the finances of all power plants. That’s especially true for wind and solar generators. Because they surge and slump en masse with the weather, new projects will have to anticipate generating most of their electricity during surges when their intermittent competitors are also over-producing and driving down prices.

Those economics look even worse than nuclear economics, especially with key federal renewables subsidies sun-setting over the next few years. Closing Diablo will give PG&E only a temporary reprieve from solar surges. As intermittent capacity grows, PG&E will increasingly have to curtail its hydro, geothermal, wind and solar capacity as well.

Would storage solve the conundrum? Yes—in part by giving nuclear power a new lease on life. With ample storage Diablo Canyon could churn out and store electricity during solar surges and sell it when the PV panels have gone to sleep—and do it more profitably than wind and solar can. Unfortunately, storage on any significant scale remains a pipe dream.

Nuclear subsidies would help correct the biases plaguing energy policy. New York’s proposed Zero-Emissions Credit for nuclear power is a huge step in the right direction, and could serve as a model for other states.

But energy policy needs a more comprehensive rethink. It’s time to question the direction in which Big Green groups like NRDC and FOE, whose lobbying has dominated policy-making on this issue, are driving the country.

As the deal to close Diablo demonstrates, their emphasis on grabbing market share for wind and solar at the expense of nuclear plants is starting to seriously impede progress on decarbonization. So is their thoughtless fixation on energy-efficiency and demand reduction as replacements for energy.

If we are to decarbonize the economy, immense new loads—transportation, home heating, industrial process heat—must be shifted to low-carbon grid power. The grid austerity that green groups are preaching under the guise of “efficiency” is a false economy and a wrong turn; encouraging more electricity use will help revive depressed markets and speed the transition to sustainable energy.

Politicians, regulators and planners need to sit down with a broader array of stake-holders and systematically plan the transition to a sustainable energy supply. They should do so with a clear understanding of the strengths and limitation of energy technologies, and take care to foster orderly markets that avoid the boom-and-bust cycles of the last two decades. And they should think carefully about how to value and conserve America’s vast resource of clean nuclear power.

Will Boisvert is a freelance journalist who lives in New York.

Additional reading

How Not to Deal with Climate Change, The New York Times, June 30, 2016

Anti-Nuclear Group NRDC Could Benefit Financially from Closing Diablo Canyon

How do we know the anti-Diablo Canyon Proposal would increase emissions? We read the fine print